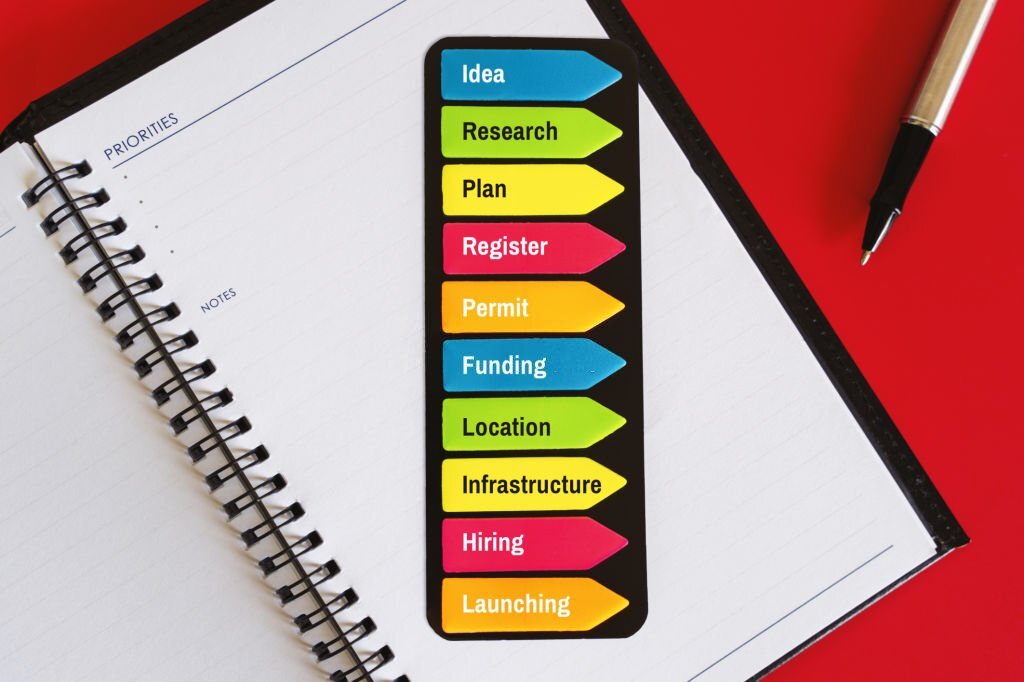

The Dos and Don’ts of Small Business Accounting

Small business accounting is a crucial aspect of running a successful venture. Properly managing your finances ensures that you have a clear understanding of your business’s financial health, enables you to make informed decisions, and helps you meet your tax obligations. In this article, we will explore the dos and don’ts of small business accounting to guide you in maintaining accurate and organized financial records.

Dos of Small Business Accounting

Maintain Separate Business and Personal Accounts

One of the first steps in small business accounting is to establish separate bank accounts for your business and personal finances. Mixing personal and business expenses can lead to confusion and make it challenging to track your business’s financial performance accurately. By keeping separate accounts, you can easily identify business-related transactions, making bookkeeping and tax preparation more manageable.

Track Income and Expenses Regularly

It is essential to maintain a record of all your business’s income and expenses consistently. Tracking these transactions in real-time helps you gain insight into your cash flow, identify potential issues, and make informed financial decisions. Regular monitoring allows you to detect discrepancies, such as missing payments or unauthorized expenses, and take appropriate action promptly.

Keep Accurate and Organized Records

Accurate record-keeping is a fundamental aspect of small business accounting. Maintain a well-organized system for storing financial documents, such as receipts, invoices, and bank statements. This practice not only simplifies day-to-day bookkeeping but also ensures that you have the necessary documentation for tax purposes or any potential audits.

Implement a Bookkeeping System

Implementing a robust bookkeeping system is crucial for managing your small business finances effectively. Consider using accounting software to streamline your bookkeeping tasks. These tools provide features like automated data entry, transaction categorization, and financial reporting, saving you time and reducing the likelihood of errors.

Don’ts of Small Business Accounting

Neglecting to Reconcile Bank Statements

Failing to reconcile your business bank statements regularly can lead to inaccurate financial records. Reconciliation involves comparing your recorded transactions with the bank statement to identify any discrepancies or errors. By neglecting this crucial step, you may overlook incorrect charges, fraudulent activities, or missed payments, which can affect your business’s financial health and credibility.

Mixing Personal and Business Expenses

Avoid the temptation of using your business account for personal expenses or vice versa. Mixing personal and business finances not only complicates your bookkeeping but also creates potential legal and tax-related issues.

Ignoring Tax Obligations

One of the biggest mistakes small business owners make is ignoring their tax obligations. Failing to meet tax deadlines or inaccurately reporting income can result in penalties, fines, and unnecessary stress. Stay updated with the tax regulations relevant to your business and ensure timely filing and payment of taxes. Consider consulting with a tax professional to ensure compliance and maximize your deductions.

Failing to Plan for Cash Flow

Cash flow management is vital for the survival and growth of any small business. Failing to plan for cash flow can lead to financial instability and difficulty in meeting obligations such as paying bills or salaries. Create a cash flow forecast to anticipate potential cash shortages or surpluses and take proactive measures to address them. Maintaining a healthy cash flow ensures your business can withstand unexpected expenses and seize growth opportunities.

Seek Professional Help When Needed

Hiring an Accountant or Bookkeeper

Managing small business accounting can be complex and time-consuming. Consider hiring an accountant or bookkeeper to handle your financial tasks. These professionals bring expertise in tax compliance, financial analysis, and reporting. Outsourcing accounting functions allows you to focus on core business activities while ensuring accuracy and adherence to financial regulations.

Utilizing Accounting Software

Accounting software has revolutionized small business accounting by automating many tasks and providing real-time insights into your financial performance. Choose a software solution that aligns with your business needs and offers features such as invoicing, expense tracking, financial reporting, and integration with banking systems. Utilizing accounting software streamlines processes, reduces errors, and facilitates better decision-making.

Stay Updated with Tax Laws and Regulations

Understanding Deductible Expenses

To optimize your small business’s financial performance, it’s essential to understand deductible expenses. Deductible expenses are costs incurred for business purposes that can be subtracted from your taxable income, reducing your overall tax liability. Familiarize yourself with the deductible expenses specific to your industry and keep detailed records to support your deductions during tax season.

Being Aware of Reporting Requirements

Small businesses have reporting requirements that vary based on their legal structure and industry. Ensure compliance with these obligations by staying informed about the necessary filings, such as annual financial statements, sales tax reports, and payroll tax filings. Failure to meet reporting requirements can result in penalties and legal complications.

Monitor and Analyze Financial Statements

Importance of Balance Sheets, Income Statements, and Cash Flow Statements

Financial statements provide a snapshot of your business’s financial health and performance. Regularly review and analyze essential statements such as balance sheets, income statements, and cash flow statements. Balance sheets show your business’s assets, liabilities, and equity, while income statements summarize revenue and expenses. Cash flow statements track the movement of cash in and out of your business. By understanding these statements, you can make informed decisions, identify trends, and address financial challenges proactively.

Using Financial Data for Decision Making

Financial data is a valuable resource for decision making in your small business. Analyze key metrics such as profitability ratios, liquidity ratios, and debt ratios to assess your business’s financial performance. This information helps you identify areas for improvement, set financial goals, and make strategic decisions to drive growth and profitability.

Utilize Technology for Efficiency

Cloud-Based Accounting Solutions

Cloud-based accounting solutions offer numerous benefits for small businesses, including accessibility, data security, and collaboration capabilities. These platforms allow you to access your financial information from anywhere, automate data backups, and collaborate with your accountant or bookkeeper in real-time. Cloud-based accounting solutions streamline your financial processes and provide peace of mind.

Automation and Integration

Take advantage of automation and integration features offered by accounting software. Automate repetitive tasks such as data entry, invoice generation, and expense tracking. Integration with other business tools like payment processors and inventory management systems can streamline your operations and ensure accurate financial data across various platforms. Embracing automation and integration saves time, reduces errors, and improves overall efficiency.

Conclusion

Effective small business accounting is essential for maintaining financial stability, making informed decisions, and meeting tax obligations. By following the dos and don’ts outlined in this article, you can establish a solid foundation for managing your finances. Remember to maintain separate business and personal accounts, track income and expenses regularly, keep accurate records, and implement a reliable bookkeeping system. Seek professional help when needed, stay updated with tax laws and regulations, and utilize technology to streamline your accounting processes. By prioritizing sound financial practices, you can set your small business up for success and sustainable growth.

FAQs (Frequently Asked Questions)

- Why is small business accounting important? Small business accounting is crucial as it helps you track income and expenses, make informed decisions, and meet tax obligations. It provides insights into your business’s financial health and helps you plan for the future.

- Should I hire an accountant or bookkeeper for my small business? Hiring an accountant or bookkeeper can be beneficial, especially if you lack expertise in accounting. They can handle complex financial tasks, ensure compliance, and provide valuable insights to optimize your business’s financial performance.

- How often should I reconcile my bank statements? It is recommended to reconcile your bank statements monthly. Regular reconciliation helps identify discrepancies, errors, or fraudulent activities and ensures accurate financial records.

- What are deductible expenses in small business accounting? Deductible expenses are business-related costs that can be subtracted from your taxable income, reducing your overall tax liability. Examples include office supplies, advertising expenses, and employee salaries.

- Can accounting software help automate my financial tasks? Yes, accounting software offers automation features that can streamline tasks such as data entry, invoice generation, and expense tracking. By automating these processes, you save time and reduce the risk of errors in your financial records.